how to use Trading Indicators for Market Analysis

Cryptocurrency and other digital assets have gained significant attention in recent years, with many traders and investors seeking ways to gain a competitive edge in the market. One of the most effective tools available is trading indicators, which provide valuable insights into market trends, patterns, and potential price movements. In this article, we’ll explore how to use trading indicators for market analysis and help you make informed investment decision.

What are trading indicators?

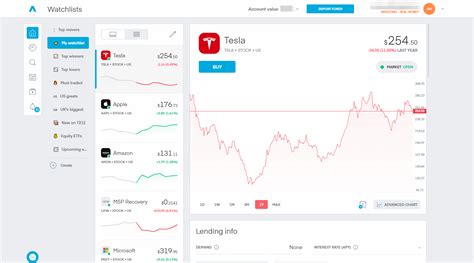

Trading indicators are graphical or numerical signals that display information about the current state of a market or asset. These indicators can be used to identify trends, predict price movements, and filter out potential risks. There are many types of trading indicators available, including chart patterns, statistical models, and time-series analysis.

Types of Trading Indicators

- Moving AVERAGES (MAS) : Mas are a popular indicator that calculate the average price of an asset over a specified period, usually 52 or 100 weeks. They helps identify trends, breakouts, and support/resistance levels.

- Relative Strength Index (RSI) : RSI is a momentum oscillator that measures the speed and change of price movements. It provides insights into the strength and weakness of an asset’s marketing.

- Bollinger Bands

: Bollinger Bands are volatility-based indicators that display a range of prices with added smoothing. They help identify trends, breakouts, and potential reversals.

- stochastic oscillator : the stochastic oscillator is another momentum oscillator that measures the relationship between price and its relative strength. It provides insights into the market’s sentiment and potential price movements.

how to use Trading Indicators for Market Analysis

To use trading indicators effectively, follow these steps:

- Choose a trading plan : before using any indicator, define your investment strategy and risk tolerance. This will help you select relevant indicators and set up a trading plan.

- Select the right indicator : Choose an indicator that aligns with your market analysis needs. For exam, if you are focusing on bullish trends, use an RSI or Bollinger Bands Indicator.

- Use indicators in combination : combine multiple indicators to create a more comprehensive picture of market conditions. This can include using Mas, RSI, and Stochastic Oscillator for added insights.

- Monitor indicators over time : regularly monitor your indicators over time to adjust your trading plan as needed.

Best Practices

- Use Historical Data : Use Historical Data to identify patterns and trends in market conditions. This will help you develop a more nuanced understanding of the market.

- Avoid over-optimism : don’t rely solely on one indicator or strategy. Regularly review your indicators and adjust your plan as needed.

- Manage Risk : Always Maintain A Risk Management Approach when using trading indicators. Set Stop-Losses, Limit Positions, and Manage Leverage to Avoid Significant Losses.

Benefits of Using Trading Indicators

- Improved Market Insights : Trading indicators provide valuable insights into market trends, patterns, and potential price movements.

- Increased confidence : By using indicators in combination with other market analysis techniques, you’ll be confidence in your investment decisions.

- enhanced trading performance : Effective use of trading indicators can lead to improved trading performance, including including wins and reduced losses.

Conclusion

Trading indicators are a valuable tool for investors seeking to gain a competitive edge in the cryptocurrency market.