understanding of negotiation volume: a deep dive in Chainlink (link)

Cryptocurrency, a digital or virtual currency that uses the encryption of safety and is decentralized, has gained significant attention in recent years. Among the many available cryptocurrencies, Chainlink (link) stands out as one of the most promising market projects. In this article, we will deepen more in the volume of negotiations in the cryptocurrency world, exploring what it means to negotiate with the connection, why traders are interested in this project and how Chainink’s unique architecture facilitates a more efficient and transparent commercial experience. .

What is the volume of negotiation?

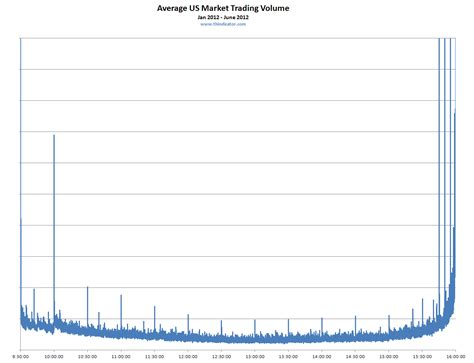

The volume of negotiation refers to the total value of all negotiations made in a specific exchange or market. It is an essential metric for cryptocurrency exchanges, which indicates the level of interest and liquidity in a specific symbol. The large volume of negotiations can be a sign of strong demand for a specific asset, while the low volume of negotiations may indicate low interest rates.

understanding chainlink (link)

Chainlink is a decentralized decentralized Oracle network that allows the creation of smart contracts on blockchain platforms. The network provides access to a wide range of data sources, such as market data, news flows and external APIs, which can be used to create self-executive contracts with specific rules.

Why are traders interested in Chainlink (link)?

There are several reasons why traders are interested in Chainlink:

1.

2.

- Faster transaction times : Chainlink’s decentralized architecture allows faster transaction times compared to traditional exchanges, reducing the time needed to solve negotiations.

- Increased security : The use of several nodes on the network ensures a high level of security and reduces the risk of data manipulation or handling.

Chainlink (link) Trading volume

As with any cryptocurrency, the volume of chain negotiations plays a significant role in determining its price movements. According to Coingecko data, the current trading volume for the link is about $ 1 billion. This indicates that traders buy and sell the connection actively, contributing to its value.

Chainlink’s unique architecture

One of Chainlink’s main features is his ability to take advantage of several knots on the network to provide real databases. This allows developers to create personalized applications that can interact with external APIs, allowing a more complex logic and functionality.

For example, a trader can use Chainlink to look for market data for a specific asset from a reliable source, such as Quandl or Alpha Advantage. The recovered data is used in your intelligent contract application, which performs the necessary transactions based on predefined rules.

Main benefits of chain (link)

Some important advantages of using chain chain include:

- Liquid increase : By using several external nodes and APIs, Chainlink offers a more diverse range of business opportunities, increasing liquidity on the market.

- Improved security : The use of decentralized data networks provides high security levels, reducing the risk of handling or manipulation.

- Faster settlement times : The fastest transaction times provided by Chainlink reduce the time required to solve negotiations, facilitating traders to meet their positions.