Mood analysis on the market in the cryptomena: observations from Tether (USDT)

In the last few years, the world of cryptocurrencies has seen rapid growth and variability, making it difficult to understand the market mood. One of the key metrics that can help investors in making informed decisions is the direction of trends and analysis of cryptocurrency sentiments such as Tether (USDT). In this article, we will analyze the moods in the USDT market and give you an overview of its potential future events.

What is tether?

Tether, also known as USDT, is set up to the US dollar. It was founded in 2014 by the Japanese business company IToch. Stablacoin is set at $ 1, making it a credible alternative for investors who want to trade cryptocurrencies without the risk of pricing fluctuations.

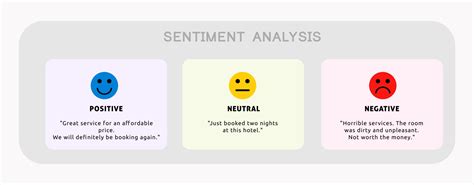

Mood analysis in the market

To analyze the moods on the market, we can look at several key indicators:

1.

2.

- Spine levels and resistance

: Identifying these levels can help investors predict pricing movements.

- Moody Metrics : such as a relative power indicator (RSI) and Bollinger Bands, which provide another view of the market trends.

Tether in the Sentiment Market market

In recent years, the moods on the Tether market have been relatively stable, with a slight change to stubbornness in 2018. Here are several key observations:

* Price Movement : Since its introduction, USDT has been constantly showing a strong upward trend that is powered by a demand for Stablein.

* Volume : The volume of USDT trading was relatively high during its existence, indicating a strong market interest.

* The level of support and resistance : The price of Tether is often filed almost $ 1.50 to $ 3.00. These levels have remained relatively unchanged over time.

Observations from market moods

Mood analysis on the market can provide valuable information about potential future successes in USDT:

* Increased demand : The trend has a permanent way up, may indicate increased demand for Stableine, leading to further prices recognition.

* Reducing variability

: Reducing variability may indicate a reduction in the mood of bears, which potentially paves the soil for stronger prices.

* Global Economic Factors : Economic indicators from countries such as China and Japan can affect the USDT market mood. For example, if the economic growth of China decreases, this may affect the value of the tie.

potential risk

Although a mood analysis in the market is needed to make informed investment decisions, it is also important to consider the potential risk:

* Modification of uncertainty : Changes in government regulations or politicians can significantly affect the stability of stable substances such as USDT.

* Market handling : Sophisticated business strategies can try to manipulate the market moods. Alert and proper care is needed to prevent such a scenario.

application

Analysis of market moods is a valuable tool for investors who want to understand the trends of cryptocurrencies and potential future success in Tether (USDT). By examining key indicators such as the movement of prices, volume levels, resistance and sentiments, we can get an overview of the fundamental forces that control the USDT value. As with any investment, it is necessary to address the analysis of mood on the market and to consider many factors before taking any decisions.

Recommendations

Based on our mood analysis in the Tether market:

* Investors who are looking for long -term growth : Consider holding USDT for a long time, as its stable and reliable nature can be a strong basis for investment.